In the rapidly evolving landscape of banking technology, core banking software serves as the foundation for financial institutions’ operations. It is the engine that powers banks, credit unions, and other financial organizations, allowing them to manage customer accounts, process transactions, and provide a wide range of financial services. As of 2023, several core banking software providers stand out, each offering unique features and benefits. In this article, we will explore what core banking software is, its key characteristics, the advantages it offers to clients, and a detailed look at the top providers in 2023.

Understanding core banking software

Core banking software is the central nervous system of any financial institution. It is a comprehensive and integrated software solution that manages all of a bank’s essential functions, from customer accounts and deposits to loans and transactions. This software ensures that a bank’s operations run efficiently, securely, and in compliance with regulatory standards. In recent years, the core banking software market has seen significant growth, as banks and financial institutions look to modernize their systems and improve efficiency.

Key characteristics of core banking software

![]() Centralization:

Centralization:

Core banking systems consolidate all banking operations into a single platform, eliminating the need for disparate, disconnected systems.

![]() Real-time Processing:

Real-time Processing:

They support real-time transaction processing, ensuring that customer transactions are updated instantly.

![]() Scalability:

Scalability:

Core banking software is designed to scale with a bank’s growth, accommodating increased customer volumes and new products and services.

![]() Security:

Security:

These systems prioritize data security and compliance with regulatory standards to protect customer information.

![]() Integration:

Integration:

They seamlessly integrate with various channels, such as mobile apps, online banking, ATMs, and more, offering customers a unified experience.

Benefits of core banking systems for clients

Financial institutions that adopt core banking systems can enjoy a multitude of benefits, ultimately leading to improved services for their clients:

![]() Enhanced Customer Experience:

Enhanced Customer Experience:

Core banking software empowers banks to offer innovative services such as mobile banking, online account management, and personalized financial products. This results in an enriched customer experience.

![]() Operational Efficiency:

Operational Efficiency:

Automation of processes within core banking systems reduces manual work, leading to operational efficiency and cost savings. These savings can be passed on to customers in the form of better rates and lower fees.

![]() Real-time Transactions:

Real-time Transactions:

Clients can perform real-time transactions, check balances, and receive immediate updates on their accounts, providing them with greater control over their finances.

![]() Comprehensive Services:

Comprehensive Services:

Core banking systems enable banks to offer a wide range of services, including loans, deposits, wealth management, and more, all from a single platform.

![]() Data Security: Enhanced security measures protect customer data, reducing the risk of fraud and data breaches, which can be reassuring to clients.

Data Security: Enhanced security measures protect customer data, reducing the risk of fraud and data breaches, which can be reassuring to clients.

Now, let’s delve into the top core banking software providers in 2023, highlighting their unique features, advantages, and drawbacks.

Core banking software list for 2023

1. Mambu

Mambu is a cloud-based banking platform that enables banks to launch and manage digital banking products and services. It was founded in 2011. Mambu offers a range of features, including account opening, payments, lending, and risk management.

Features of Mambu Core Banking System:

![]() composable banking platform,

composable banking platform,

![]() loan origination and deposit management capabilities,

loan origination and deposit management capabilities,

![]() customer relationship management tools.

customer relationship management tools.

Pros:

![]() flexible and customizable,

flexible and customizable,

![]() enables quick product launches,

enables quick product launches,

![]() scalable for institutions of all sizes.

scalable for institutions of all sizes.

Cons:

![]() customization may require high technical expertise,

customization may require high technical expertise,

![]() costs can vary depending on the level of customization and usage,

costs can vary depending on the level of customization and usage,

![]()

customization can lead to higher costs.

2. Thought Machine

Vault by Thought Machine is a cloud-native core banking system that helps banks to modernize their IT infrastructure. It was founded in 2014. Vault offers a modular architecture that can be tailored to the specific needs of a bank.

Features of Thought Machine Vault:

![]() scalable core banking platform,

scalable core banking platform,

![]() focus on scalability and security,

focus on scalability and security,

![]() advanced principles of modern engineering.

advanced principles of modern engineering.

Pros:

![]() high scalability to accommodate growth,

high scalability to accommodate growth,

![]() secure and modern architecture.

secure and modern architecture.

Cons:

![]() implementation may require a learning curve,

implementation may require a learning curve,

![]() costs can increase with extensive customization,

costs can increase with extensive customization,

![]()

customization can lead to higher costs.

3. BOS by INCAT– pioneering the future of core banking

Founded in 2015 BOS is a leading core banking software for small and medium financial institutions. BOS stands out as a trailblazer, setting new standards for the industry. This all-in-one core system has emerged as one of the most significant and influential platforms for financial institutions in 2023.

BOS empowers leading European and international fintechs and digital banks (such as ZEN.com or Payman Group) and it is the main IT engine for global financial institutions from e.g. Saudi Arabia, Belgium, Poland, Lithuania, Bulgaria or Hungary. INCAT, the system provider, was awarded with Forbes Diamond 2023, Fintech Insurtech Awards 2021, Technology Leader 2021 and was also on the short list of the Banking Tech Awards by the Fintech Futures publishing house.

BOS’ competitive advantages:

![]() cloud native and cloud-agnostic nature (can be embedded on any cloud)

cloud native and cloud-agnostic nature (can be embedded on any cloud)

![]() event-driven architecture (every customer’s action in the system is an event)

event-driven architecture (every customer’s action in the system is an event)

![]()

based on 40+ microservices,

![]()

open-sources technologies,

![]() high standards of security,

high standards of security,

![]() zero downtime deployment.

zero downtime deployment.

Pros:

![]() tailored for fintechs and digital banks,

tailored for fintechs and digital banks,

![]() affordable pricing (available as a SaaS or a license),

affordable pricing (available as a SaaS or a license),

![]() fully scalable (grows with your organization thanks to the concept of business lines),

fully scalable (grows with your organization thanks to the concept of business lines),

![]() easily integrated (thanks to Open API),

easily integrated (thanks to Open API),

![]() high customer satisfaction ratings.

high customer satisfaction ratings.

Cons:

![]() dedicated to small and medium-sized financial institutions,

dedicated to small and medium-sized financial institutions,

![]() limited possibilities (e.g. no solutions for building mortgage products)

limited possibilities (e.g. no solutions for building mortgage products)

Contact us to learn more about BOS >>

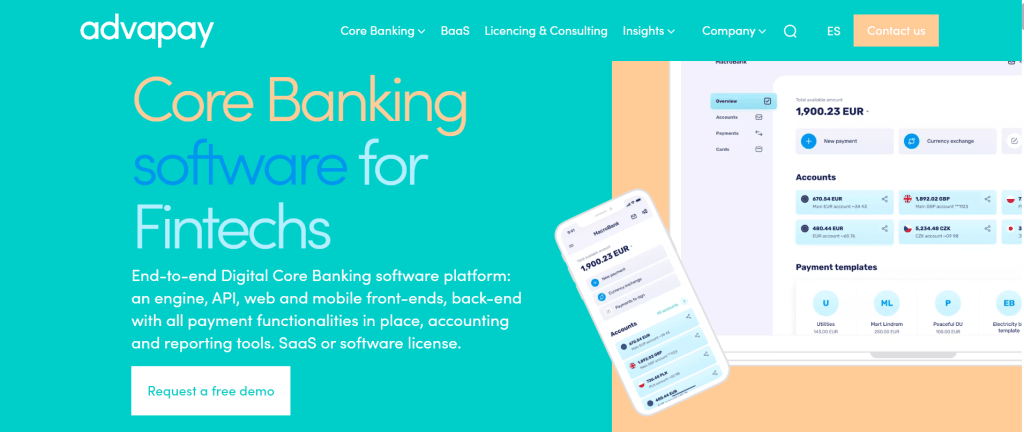

4. Advapay

Advapay is a cloud-based payments platform that enables banks to process payments. It was founded in 2015 and offers a variety of payment processing options, including credit cards, debit cards, and e-wallets.

Features of Advapay:

![]() modular solutions for digital banking,

modular solutions for digital banking,

![]() compliance and risk management tools,

compliance and risk management tools,

![]() tailored for payment institutions.

tailored for payment institutions.

Pros:

![]() modular approach for tailored solutions,

modular approach for tailored solutions,

![]()

focus on compliance and risk management,

Cons:

![]() may not be suitable for traditional banking institutions,

may not be suitable for traditional banking institutions,

![]() customization can lead to higher costs,

customization can lead to higher costs,

![]() may not be suitable for large financial institutions.

may not be suitable for large financial institutions.

5. Finastra

Finastra is a financial technology company that provides software and services to banks and other financial institutions. It was founded in 2015 through the merger of Misys and D+H.

Features of Finastra:

![]() wide range of banking software, including retail and corporate banking,

wide range of banking software, including retail and corporate banking,

![]() solutions for banks of all sizes,

solutions for banks of all sizes,

![]() focus on modernizing banking operations.

focus on modernizing banking operations.

Pros:

![]() comprehensive suite of banking software,

comprehensive suite of banking software,

![]() tailored solutions for various banking segments,

tailored solutions for various banking segments,

![]() assistance in the modernization of operations.

assistance in the modernization of operations.

Cons:

![]()

costs may vary based on the extent of customization.

![]()

integration challenges in complex IT environments.

Other providers:

6. Infosys Finacle

Infosys Finacle is a cloud-based core banking system that is designed to be scalable and flexible. It is offered by Infosys, a global technology company that was founded in 1981. Infosys Finacle has over 2,000 customers worldwide, including banks in emerging markets. Infosys Finacle is a popular choice for banks in emerging markets because it is scalable and flexible, and it offers a wide range of features and functionality. It is also a good choice for banks that are looking to adopt new technologies, such as cloud computing or artificial intelligence.

7. Oracle Flexcube

FLEXCUBE is an automated universal core banking software developed and introduced by Oracle Financial Services. This solution is designed for financial organizations and banks. It offers customer-centric core banking functionalities. It ensures a holistic view of all customers and enhanced communication between bank employees and consumers.

8. nCino

Launched in 2012, nCino offers a cloud-based bank operating system created by bankers for bankers. The system helps increase profitability, productivity gains, regulatory compliance, and operational transparency at all organizational levels as well as across all lines of business. Following a process structure similar to a bank’s loan accounting system, this bank operating system offers combined services through its business process management, loan lifecycle, business intelligence, and document management solutions.

9. Backbase

Backbase was founded in 2003 and provides all the building blocks banks need to fast- track the implementation of their next-generation digital banking vision. The platform enables banks to create and manage seamless customer experiences across any device that’s directly integrated with any back-end system. Superior digital experiences are essential to staying relevant to consumers, and Backbase enables financial companies to rapidly grow their digital business.

10. Temenos T24

Temenos T24 is a modular core banking system that is designed to meet the needs of banks of all sizes. Founded in 1993, Temenos T24 has over 2,500 customers worldwide, including banks in Europe, the Middle East, and Africa.

Temenos T24 is a modular core banking system that is designed to meet the needs of banks of all sizes. Founded in 1993, Temenos T24 has over 2,500 customers worldwide, including banks in Europe, the Middle East, and Africa.