10 top core banking solutions in 2023

In the rapidly evolving landscape of banking technology, core banking software serves as the foundation for financial institutions' operations. It is the engine that powers banks, credit unions, and other financial organizations, allowing them to manage customer accounts, process transactions, and provide a wide range of financial services. As of 2023, several core banking software providers stand out, each offering unique features and benefits. In this article, we will explore what core banking software is, its key characteristics, the advantages it offers to clients, and a detailed look at the top providers in 2023.

Understanding core banking software

Core banking software is the central nervous system of any financial institution. It is a comprehensive and integrated software solution that manages all of a bank's essential functions, from customer accounts and deposits to loans and transactions. This software ensures that a bank's operations run efficiently, securely, and in compliance with regulatory standards. In recent years, the core banking software market has seen significant growth, as banks and financial institutions look to modernize their systems and improve efficiency.

Key characteristics of core banking software

![]() Centralization:

Centralization:

Core banking systems consolidate all banking operations into a single platform, eliminating the need for disparate, disconnected systems.

![]() Real-time Processing:

Real-time Processing:

They support real-time transaction processing, ensuring that customer transactions are updated instantly.

![]() Scalability:

Scalability:

Core banking software is designed to scale with a bank's growth, accommodating increased customer volumes and new products and services.

![]() Security:

Security:

These systems prioritize data security and compliance with regulatory standards to protect customer information.

![]() Integration:

Integration:

They seamlessly integrate with various channels, such as mobile apps, online banking, ATMs, and more, offering customers a unified experience.

Benefits of core banking systems for clients

Financial institutions that adopt core banking systems can enjoy a multitude of benefits, ultimately leading to improved services for their clients:

![]() Enhanced Customer Experience:

Enhanced Customer Experience:

Core banking software empowers banks to offer innovative services such as mobile banking, online account management, and personalized financial products. This results in an enriched customer experience.

![]() Operational Efficiency:

Operational Efficiency:

Automation of processes within core banking systems reduces manual work, leading to operational efficiency and cost savings. These savings can be passed on to customers in the form of better rates and lower fees.

![]() Real-time Transactions:

Real-time Transactions:

Clients can perform real-time transactions, check balances, and receive immediate updates on their accounts, providing them with greater control over their finances.

![]() Comprehensive Services:

Comprehensive Services:

Core banking systems enable banks to offer a wide range of services, including loans, deposits, wealth management, and more, all from a single platform.

![]() Data Security: Enhanced security measures protect customer data, reducing the risk of fraud and data breaches, which can be reassuring to clients.

Data Security: Enhanced security measures protect customer data, reducing the risk of fraud and data breaches, which can be reassuring to clients.

Now, let's delve into the top core banking software providers in 2023, highlighting their unique features, advantages, and drawbacks.

Core banking software list for 2023

1. Mambu

Mambu is a cloud-based banking platform that enables banks to launch and manage digital banking products and services. It was founded in 2011. Mambu offers a range of features, including account opening, payments, lending, and risk management.

Features of Mambu Core Banking System:

![]() composable banking platform,

composable banking platform,

![]() loan origination and deposit management capabilities,

loan origination and deposit management capabilities,

![]() customer relationship management tools.

customer relationship management tools.

Pros:

![]() flexible and customizable,

flexible and customizable,

![]() enables quick product launches,

enables quick product launches,

![]() scalable for institutions of all sizes.

scalable for institutions of all sizes.

Cons:

![]() customization may require high technical expertise,

customization may require high technical expertise,

![]() costs can vary depending on the level of customization and usage,

costs can vary depending on the level of customization and usage,

![]()

customization can lead to higher costs.

2. Thought Machine

Vault by Thought Machine is a cloud-native core banking system that helps banks to modernize their IT infrastructure. It was founded in 2014. Vault offers a modular architecture that can be tailored to the specific needs of a bank.

Features of Thought Machine Vault:

![]() scalable core banking platform,

scalable core banking platform,

![]() focus on scalability and security,

focus on scalability and security,

![]() advanced principles of modern engineering.

advanced principles of modern engineering.

Pros:

![]() high scalability to accommodate growth,

high scalability to accommodate growth,

![]() secure and modern architecture.

secure and modern architecture.

Cons:

![]() implementation may require a learning curve,

implementation may require a learning curve,

![]() costs can increase with extensive customization,

costs can increase with extensive customization,

![]()

customization can lead to higher costs.

3. BOS by INCAT– pioneering the future of core banking

Founded in 2015 BOS is a leading core banking software for small and medium financial institutions. BOS stands out as a trailblazer, setting new standards for the industry. This all-in-one core system has emerged as one of the most significant and influential platforms for financial institutions in 2023.

BOS empowers leading European and international fintechs and digital banks (such as ZEN.com or Payman Group) and it is the main IT engine for global financial institutions from e.g. Saudi Arabia, Belgium, Poland, Lithuania, Bulgaria or Hungary. INCAT, the system provider, was awarded with Forbes Diamond 2023, Fintech Insurtech Awards 2021, Technology Leader 2021 and was also on the short list of the Banking Tech Awards by the Fintech Futures publishing house.

BOS' competitive advantages:

![]() cloud native and cloud-agnostic nature (can be embedded on any cloud)

cloud native and cloud-agnostic nature (can be embedded on any cloud)

![]() event-driven architecture (every customer's action in the system is an event)

event-driven architecture (every customer's action in the system is an event)

![]()

based on 40+ microservices,

![]()

open-sources technologies,

![]() high standards of security,

high standards of security,

![]() zero downtime deployment.

zero downtime deployment.

Pros:

![]() tailored for fintechs and digital banks,

tailored for fintechs and digital banks,

![]() affordable pricing (available as a SaaS or a license),

affordable pricing (available as a SaaS or a license),

![]() fully scalable (grows with your organization thanks to the concept of business lines),

fully scalable (grows with your organization thanks to the concept of business lines),

![]() easily integrated (thanks to Open API),

easily integrated (thanks to Open API),

![]() high customer satisfaction ratings.

high customer satisfaction ratings.

Cons:

![]() dedicated to small and medium-sized financial institutions,

dedicated to small and medium-sized financial institutions,

![]() limited possibilities (e.g. no solutions for building mortgage products)

limited possibilities (e.g. no solutions for building mortgage products)

Contact us to learn more about BOS >>

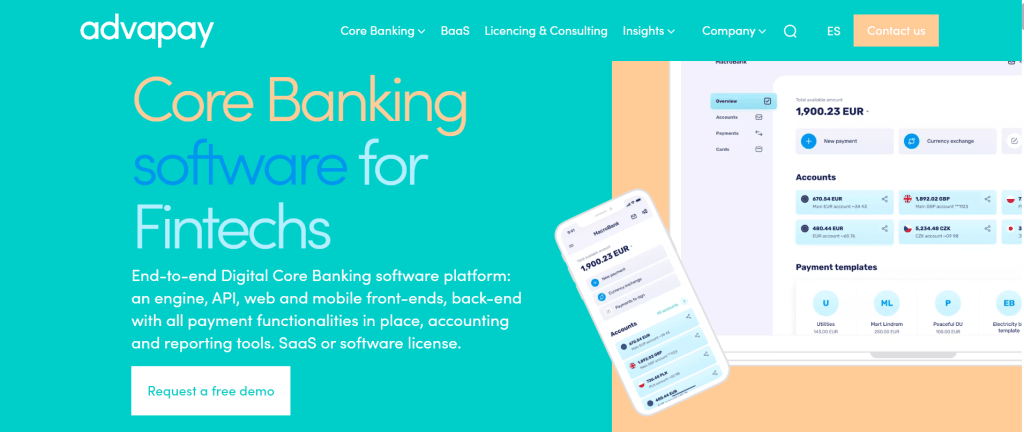

4. Advapay

Advapay is a cloud-based payments platform that enables banks to process payments. It was founded in 2015 and offers a variety of payment processing options, including credit cards, debit cards, and e-wallets.

Features of Advapay:

![]() modular solutions for digital banking,

modular solutions for digital banking,

![]() compliance and risk management tools,

compliance and risk management tools,

![]() tailored for payment institutions.

tailored for payment institutions.

Pros:

![]() modular approach for tailored solutions,

modular approach for tailored solutions,

![]()

focus on compliance and risk management,

Cons:

![]() may not be suitable for traditional banking institutions,

may not be suitable for traditional banking institutions,

![]() customization can lead to higher costs,

customization can lead to higher costs,

![]() may not be suitable for large financial institutions.

may not be suitable for large financial institutions.

5. Finastra

Finastra is a financial technology company that provides software and services to banks and other financial institutions. It was founded in 2015 through the merger of Misys and D+H.

Features of Finastra:

![]() wide range of banking software, including retail and corporate banking,

wide range of banking software, including retail and corporate banking,

![]() solutions for banks of all sizes,

solutions for banks of all sizes,

![]() focus on modernizing banking operations.

focus on modernizing banking operations.

Pros:

![]() comprehensive suite of banking software,

comprehensive suite of banking software,

![]() tailored solutions for various banking segments,

tailored solutions for various banking segments,

![]() assistance in the modernization of operations.

assistance in the modernization of operations.

Cons:

![]()

costs may vary based on the extent of customization.

![]()

integration challenges in complex IT environments.

Other providers:

6. Infosys Finacle

Infosys Finacle is a cloud-based core banking system that is designed to be scalable and flexible. It is offered by Infosys, a global technology company that was founded in 1981. Infosys Finacle has over 2,000 customers worldwide, including banks in emerging markets. Infosys Finacle is a popular choice for banks in emerging markets because it is scalable and flexible, and it offers a wide range of features and functionality. It is also a good choice for banks that are looking to adopt new technologies, such as cloud computing or artificial intelligence.

7. Oracle Flexcube

FLEXCUBE is an automated universal core banking software developed and introduced by Oracle Financial Services. This solution is designed for financial organizations and banks. It offers customer-centric core banking functionalities. It ensures a holistic view of all customers and enhanced communication between bank employees and consumers.

8. nCino

Launched in 2012, nCino offers a cloud-based bank operating system created by bankers for bankers. The system helps increase profitability, productivity gains, regulatory compliance, and operational transparency at all organizational levels as well as across all lines of business. Following a process structure similar to a bank’s loan accounting system, this bank operating system offers combined services through its business process management, loan lifecycle, business intelligence, and document management solutions.

9. Backbase

Backbase was founded in 2003 and provides all the building blocks banks need to fast- track the implementation of their next-generation digital banking vision. The platform enables banks to create and manage seamless customer experiences across any device that's directly integrated with any back-end system. Superior digital experiences are essential to staying relevant to consumers, and Backbase enables financial companies to rapidly grow their digital business.

10. Temenos T24

Temenos T24 is a modular core banking system that is designed to meet the needs of banks of all sizes. Founded in 1993, Temenos T24 has over 2,500 customers worldwide, including banks in Europe, the Middle East, and Africa.

Temenos T24 is a modular core banking system that is designed to meet the needs of banks of all sizes. Founded in 1993, Temenos T24 has over 2,500 customers worldwide, including banks in Europe, the Middle East, and Africa.

Core banking software list for 2022

9 top core banking solutions you should know

The banking industry is a sector of the economy, that, in recent years, has experienced very dynamic digitization processes, which were additionally strengthened and accelerated by the COVID19 pandemic. However, this is not surprising. A recent report released by Ernst & Young showed that almost 50% of banks did not modernize outdated IT systems as quickly as they should have, and almost 43% of American banks still used COBOL – a programming language developed in 1959! Fortunately, providers of more and more modern core banking solutions, created in almost all corners of the world, come to the rescue.

The definition of core banking

A back-end system that processes banking transactions throughout a bank’s multiple branches is known as core banking. Deposit, loan, and payment processing are all parts of such a system. In addition floating new accounts, servicing loans, calculating interest, processing deposits and transactions, and customer relationship management activities are all essential fundamental banking services in this type of system.

Core banking systems are designed to give existing and potential customers more control over their account activity. Thanks to technological advancements, transactions have become safer, faster, and less demanding. Core banking systems have been a critical feature of banking in recent years because these transactions can be completed remotely from anywhere on the planet.

Core banking solutions may reduce operational costs significantly, resulting in fewer work requirements for execution. They also allow customers to be more accountable. In addition, core banking systems are more user- friendly and efficient thanks to software application-based platforms. The advantages of core banking systems are numerous, including keeping up with a rapidly changing market, streamlining banking operations and making them more straightforward for customers, and expanding a bank’s reach to remote locations.

Born in the cloud

According to Gartner- by the end of 2023, public and private cloud will each account for 5% of commercial off-the-shelf (COTS) core banking installations for an overall 10% of the COTS market. New core banking software platforms are built on cloud and digital technologies and use open API-based architecture to better interface with various internal and external services and systems.

Lower costs, faster time-to-market and more superficial connections with multiple services that may improve customer experiences are all advantages of new core banking systems. However, developing core banking software in-house is a complicated and time-consuming process that can overwhelm teams and delay product launches. Many well-known fintech brands have outsourced their core banking software from fintech providers.

Below, we present nine of the most interesting IT solutions on the market that are worth considering when choosing a modern and technologically advanced transaction system for your financial business.

Core banking software list for 2022

1. Mambu – SaaS cloud banking platform

Launched in 2011, Mambu is a software-as-a-service, cloud-native, API-driven banking engine provider that powers lending and deposit services. The company enables financial institutions of all sizes to design, launch, service, and scale their banking and lending portfolio. It empowers over 7,000 loan and deposit products which serve over eight million end customers, with more than three million active accounts in over 46 countries, ranging from fintech to traditional banks. Mambu’s historical customer base includes microfinance institutions and fintechs. However, Mambu currently focuses on larger banks launching spinoffs or migrating. Its installation base is spread mainly across Western Europe, Latin America, and sub-Saharan Africa. The country with the most installations is the U.K.

2. Thought Machine – foundation of modern banking

Thought Machine is a fintech company that builds cloud-native technology to revolutionize core banking. Its mission is to solve one of the banking industry's primary problems: its reliance on outdated IT infrastructure. Nearly all banks are stuck on a legacy IT platform, which cripples their ability to innovate and give their customers the type of service they deserve.

The company provides a solution to this: Vault - a complete retail banking platform that's capable of being configured easily to suit the needs of any bank. They've built Vault from the ground up as a cloud-native, microservice API architecture platform. Thought Machine has a deep culture of engineering excellence, and they believe it's this that delivers a solution compelling enough to engender a seismic shift in the banking industry.

3. BOS by INCAT– bringing the digital revolution to banking

Founded in 2018 BOS is a fully flexible, cloud-native, and composable transaction system dedicated to fintech start-ups and neo/challenger banks. BOS has been created by INCAT – a fast-growing tech company that wants to empower companies to bring the digital revolution to finance and banking.

The BOS system is perceived as one of the most flexible banking software on the market, and is a first-choice solution for companies looking for quick implementation, reasonable costs, and easy integration with external systems. BOS is cloud-native, API-driven, and based on microservices software solution. It has been built from scratch to operate securely and efficiently in the cloud, but it can also be installed in any computing center (private cloud, on-premises).

BOS system is perceived as one of the most flexible banking software on the market

BOS' functionality is designed according to the Business Lines- concept (BOS Core, Payments, Savings, Lending, General Ledger) and is tailored to the customer's business ideas and goals. The system is available as a licensed solution with implementation and maintenance support, as well as a subscription model based on license rental with maintenance support, preceded by implementation of the system (low entry cost threshold). BOS is also a sharia-compliant core banking software. It allows its customers to run any financial products in compliance with Islamic law. The software is used by next-gen international fintech brands all around the world (Belgium, Saudi Arabia, Lithuania, Poland, Hungary etc.).

4. Temenos - a digital core-banking solution you can bank on

Temenos Group AG is a market-leading provider of banking software systems to retail, corporate, universal, private, Islamic, microfinance and community banks.

Headquartered in Geneva with 68 offices worldwide, Temenos serves over 1,000 financial institutions in more than 125 countries across the world. It was founded in 1993 in Geneva, Switzerland. From the outset, it had a simple mission: to rid the banking industry of its legacy software.

Ever since then, Temenos has worked to make this mission a reality. It has invested more than USD1bn in developing great banking solutions. It has grown its product set from core banking to payments, wealth management, business analytics and channels, offering a comprehensive set of solutions to meet the industry’s needs.

5. FIS - the foundation stone of a modern banking platform

FIS is an American multinational Fortune 500 corporation that offers a wide range of financial products and services.

FIS is best known for its development of Financial Technology - FinTech - and as of Q2 2020, it offers its solutions in three primary segments: Merchant Solutions, Banking Solutions, and Capital Market Solutions. FIS focuses on retail and institutional banking, payments, asset and wealth management, risk and compliance, and outsourcing solutions. It serves more than 20,000 clients in over 130 countries.

6. Oracle Flexcube - Core Banking Made for Tomorrow

FLEXCUBE is an automated universal core banking software developed and introduced by Oracle Financial Services. This solution is designed for financial organizations and banks. It offers customer-centric core banking functionalities. It ensures a holistic view of all customers and enhanced communication between bank employees and consumers.

Due to FLEXCUBE’s opensource environment and multiple API management, its users can create their business logic and interfaces, as well as integrate the system with third-party applications. This international core banking system is compliant with various regulations and suitable for any bank in over 115 countries.

7. Finastra – the future of banking

Formed in 2017 by the merger of Misys and D+H, Finastra provides a broad portfolio of financial services, spanning across retail banking, transaction banking, lending, and treasury and capital markets. The solution enables customers to deploy mission-critical technology on-premises or in the cloud. Finastra is an open and reliable solution that allows customers to accelerate growth, optimize costs and mitigate risk. Forty-eight of the world’s top fifty banks use Finastra technology.

8. nCino - by bankers for bankers

Launched in 2012, nCino offers a cloud-based bank operating system created by bankers for bankers. The system helps increase profitability, productivity gains, regulatory compliance, and operational transparency at all organizational levels as well as across all lines of business.

Following a process structure similar to a bank’s loan accounting system, this bank operating system offers combined services through its business process management, loan lifecycle, business intelligence, and document management solutions.

9. Backbase - re-design your bank around the customer

Backbase was founded in 2003 and provides all the building blocks banks need to fast- track the implementation of their next-generation digital banking vision. The platform enables banks to create and manage seamless customer experiences across any device that's directly integrated with any back-end system. Superior digital experiences are essential to staying relevant to consumers, and Backbase enables financial companies to rapidly grow their digital business.

More than 150 banks and credit unions around the world have standardized the Backbase platform to streamline their omnichannel/digital operations, including ABN AMRO, Barclays, CheBanca!, Credit Suisse, Deutsche Bank, Fidelity, Hapoalim, HDFC, KeyBank, NBAD, OTP, PZU, PostFinance, Societe Generale, and Westpac.

As we can see in the above list, there are more and more solutions that can respond to increasingly demanding fintech companies.

However, it's worth looking for a solution that in addition to its technologically advanced architecture, is able to flexibly adapt to all of our needs and enable a quick launch of any financial product.

INCAT FaaS AI as a trading platform for one of Saudi Arabia's first digital banks

Our client is one of the leading Arab banks which, in order to fully digitize its services, creates one of the first digital cloud banks in Saudi Arabia. The implementation of the FaaS AI fintech service allows the launch of a commercial offer for future digital bank customers. In this project, INCAT acts as a technology partner and supplier of the main transaction system and project teams as part of the IT outsourcing service.

What is INCAT FaaS AI?

INCAT FaaS AI is a trading platform that acts as a sandbox for beginner fintechs, challenger banks and digital banks. The platform in the form of a service enables efficient implementation of all processes necessary to launch financial services. The implementation does not require the client's environment, because the platform enables the installation of a full range of cloud services.

You can read more on INCAT https://incat.com.pl/faas-ai/

What were the client's needs?

Until now, strict financial laws in Saudi Arabia did not allow the creation of digital financial services, installed in the cloud. Only recently, the new legislation provides space for full digitization of banking. The client, in order to be able to offer his solution on the commercial market and become a pioneer in the field of modern financial services, needed a transactional solution that would allow for a very fast implementation process, significantly shortened compared to standard implementations of this type. The use of INCAT FaaS AI functionality seemed to be the optimal solution in this approach, addressing the client's requirements: the need for efficient implementation of a commercial product, compliance with restrictive formal requirements set by local regulators, the need to market verification of a new business model on the Saudi Arabian financial market and cost optimization related to the use of system resources.

The client did not have a specialized technical team that would be able to carry out such a technologically advanced implementation, which is why we, as a technical partner, also had the obligation to provide independent and competent IT teams that would take up this challenge.

The role of INCAT FaaS AI

In this project, INCAT's FaaS AI components, installed in the public cloud, cover customer and account processing, as well as card transaction and payment processing. For the FaaS AI implementation itself, we used our skilled implementation and development team.

The biggest challenge

The biggest challenge while working on the project proved to be the limitations of the local financial system, which imposes high requirements for compliance with internal legislation and restricts the ability to provide key services from outside Saudi Arabia. INCAT as a system provider, processing clients' financial data, has to meet a number of conditions, resulting from the regulation of Saudi Arabia's financial law. In addition, our approach was important: technological flexibility (cloud agnostic), flexibility of Incat's business models, and the ability to adapt to remote and pandemic project implementation system.

- Functionalities that we implemented in the project

- Data processing of customers and their accounts

- Managing financial processes and products

- Processing of money transfers and card payments

- Installation of the solution in the public cloud

Effects

Thanks to the efficient implementation of INCAT FaaS AI components, the client is preparing for the commercial MVP implementation of its solution, which is planned for Q3 2021.