This is the first article from the “BOS Inside” series in which we will introduce you to our system from the perspective of its architecture, functionality and main technological advantages.

Core banking systems are the backbone of financial institutions that enable them to manage their day-to-day operations efficiently. The system provides functionality that ranges from opening and managing accounts to processing payments, managing deposits, creating loan accounts and calculating interest rates. In recent years, the financial industry has seen a shift towards event-driven architectures that allow for better scalability, flexibility, and faster time-to-market. One example of a core banking system that utilizes event-driven architecture is the BOS system provided by INCAT.

What is event-driven architecture?

Event-driven architecture is a communication model where the system reacts to an event rather than relying on traditional request-response interactions. Events can be anything from a user interaction to changes in the state of the system or external data source. By using an event-driven architecture, core banking systems can respond to these events in real-time, improving system performance, reducing latency, and increasing scalability.

The event-driven model allows for a loosely coupled and highly decoupled system that can adapt to changes in demand without significant modifications to the core system.

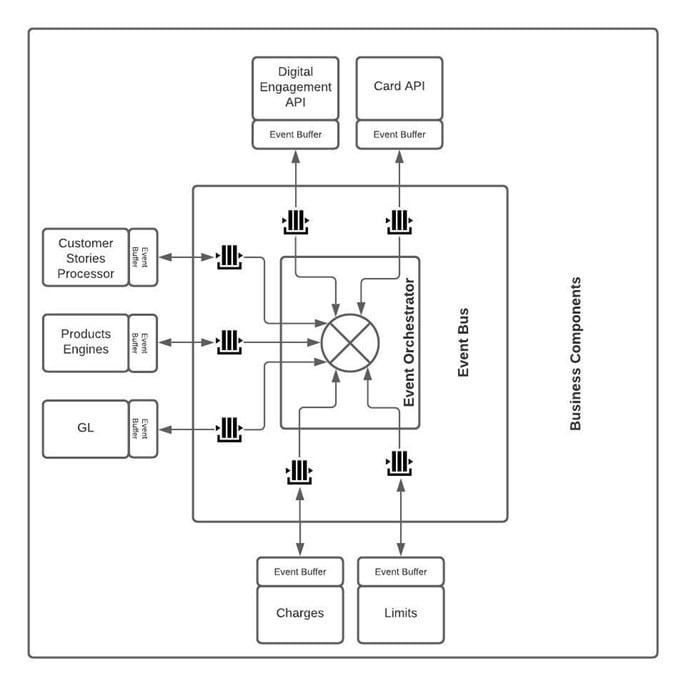

The main components of the event-driven architecture of the BOS system are:

![]() Event Orchestrator – a component that allows for the implementation of event distribution processes along with the definition of dependencies between generated events.

Event Orchestrator – a component that allows for the implementation of event distribution processes along with the definition of dependencies between generated events.

![]() Event Bus – a set of queues based on Kafka technologies, allowing for asynchronous exchange of messages.

Event Bus – a set of queues based on Kafka technologies, allowing for asynchronous exchange of messages.

![]() Event Buffer – a component built into business microservices that ensures the transactionality of message exchange and allows you to manage the business processing of events in the business microservice.

Event Buffer – a component built into business microservices that ensures the transactionality of message exchange and allows you to manage the business processing of events in the business microservice.

How BOS Uses Event-Driven Architecture?

BOS’ event-driven nature allows for seamless integration with other systems and provides high flexibility and scalability. The system’s communication model follows a publish-subscribe pattern, where events are published by producers and subscribed to by consumers. The publish-subscribe model allows for efficient and scalable communication between the system’s components.

The BOS system has a robust event processing engine that can handle a high volume of events in real-time. The system’s event processing engine uses an internal event bus that allows for the easy management and routing of events. The event bus allows the system to route events to the appropriate component and ensures that the events are processed in a timely manner. The event processing engine also allows for the filtering, transformation, and aggregation of events, providing a high degree of flexibility.

The system’s event-driven approach allows for easy integration with third-party systems. The event-driven model enables easy data exchange and sharing between the system and other systems, providing a high degree of interoperability. In addition, the system’s APIs also support easy integration with other solutions.

Where does BOS utilize event-driven architecture?

BOS rely on the event-driven architecture in various key areas, including:

![]() Account Management: to manage the opening and closing of accounts, updating account balances, and managing account status changes.

Account Management: to manage the opening and closing of accounts, updating account balances, and managing account status changes.

![]() Transaction Management: to manage transactions, including the initiation, processing, and settlement of transactions.

Transaction Management: to manage transactions, including the initiation, processing, and settlement of transactions.

![]() Customer Management: to manage customer-related activities, including customer onboarding, account access management, and customer data updates.

Customer Management: to manage customer-related activities, including customer onboarding, account access management, and customer data updates.

Benefits of BOS’ event-driven architecture

One of the key advantages of BOS’ event-driven architecture is its ability to handle complex and dynamic data flows. In a traditional architecture, data flow is managed through a central controller, which can quickly become a bottleneck as data volumes increase. With an event-driven architecture, data flow is managed through a distributed network of modules, which can handle data volumes more efficiently and scale dynamically as the system grows.

Another feature of BOS’ even driven nature is its ability to enable real-time data processing and analysis. With traditional architectures, data processing is often batch-based, which means that data is processed in batches at predetermined intervals. This approach can lead to delays in data processing and analysis, which can impact the overall efficiency of the system. With the event-driven architecture, data processing is performed in real-time, enabling financial organizations to make the right decisions based on up-to-date information.

In addition to its advanced architecture, the BOS Core Banking System also offers a comprehensive set of features and modules. This approach enables banks to build a system that is tailored to their business requirements, which can help them to operate more efficiently and effectively.

In conclusion, the adoption of event-driven architecture in core banking systems is a significant development in the banking industry. With its advanced architecture and modular design, the BOS core banking system is well positioned to help banks and fintechs in the digital age.