Funding for start-ups. Where to look for financial support for the next unicorns?

In recent years, we have seen an impressive increase in new fintech projects. It is estimated that the value of the entire fintech market will reach an astronomical sum of USD 266.9 billion by 2027. The solutions created by fintechs are revolutionizing the way of looking at finance, creating needs in line with the direction of technology development. However, building a financial startup requires a lot of cash. Fortunately, the market currently offers a fairly wide range of funding options for newly established fintechs. On the one hand, external investors are increasingly looking for investments in financial innovations, and on the other hand, project development can be based on the form of the so-called 'mixed funding'. There are quite a few options, depending on the business model, business goals, and type of product or service offered. We have collected the most interesting funding opportunities for fintech start-ups.

I. External investors

Finding an investor from outside the company is the first way to fund a fintech. In addition to a cash contribution, the investors often also help a given company enter the business world, and gain contacts and experience. Of course, someone who invests his money in fintech is not a passive observer, but a partner with partial control and influence over the company's operations. Good cooperation with an external investor is the key to success. There are many ways to attract an external investor, including:

1) Venture capital - a type of external investment for companies from the small and medium-sized enterprise sector, in which the investor (usually a large enterprise) makes a cash contribution to the company by buying its shares. Such an entity becomes a co-owner of the fintech, supports the project financially, but also manages the work and interferes in the decisions made. Thanks to the contract concluded for a strictly defined period, the originator is not afraid that they will lose money overnight.

Among European VCs interested in investing in fintech projects, the following organizations should be considered:

![]() Global Founders Capital based in Berlin,

Global Founders Capital based in Berlin,

![]() F10 based in Zurich,

F10 based in Zurich,

![]() Speed Invest based in Vienna,

Speed Invest based in Vienna,

![]() GSR based in London,

GSR based in London,

![]() SoftBank Vision Fund based in London,

SoftBank Vision Fund based in London,

![]() Picus Capital based in Munich,

Picus Capital based in Munich,

![]() Anthemis Group based in London,

Anthemis Group based in London,

![]() and Eurazeo based in Paris.

and Eurazeo based in Paris.

2) Business angels - in the case of this method of investing, we are dealing only with investments from our own funds. Business Angels are private investors who are willing to look for innovative companies where they hope to get profits from shares for help in the form of a cash contribution.

The 10 most active fintech investment angels from 2021 include:

- Chris Adelsbach (UK)

Adelsbach's multiple pre-seed and seed fintech investments last year were spread across Europe and included Berlin's re:cap, London's Pixie, twig and BondAval, Madrid's Getlife and Riga's Zelf.

- Charlie Delingpole (UK)

Among his fintech investments in 2021 were Hungary’s Seon, Warsaw’s Ramp, London’s BondAval and Plum, and Amsterdam’s Sprinque.

- Perry Blacher (UK)

In 2021, his thirteen European fintech investments included Onfido cofounder Eamon Jubbawy’s new SaaS fintech Sequence, Bulgarian b2b expense management fintech Payhawk, Berlin’s revenue-based financing startup re:cap, and Warsaw’s crypto payments startup Ramp.

- Michael Pennington

His 2021 fintech investments included creator economy financing startup Peblo, revenue-based financing startup Vitt, credit card startup Yonder and Carmoola car insurance.

- Matt Robinson

In 2021, he invested in ten European fintechs, which also included Yonder, compliance fintech Argus, German insurtech Feather and Georgian payments startup Payze.

3) Investment funds - a form of funding that consists in the collective investment of funds paid in by fund participants. Then, these funds are invested in the company's securities, and the profits come mainly from the change in their value.

The largest investment funds in the world, focused on investments in fintech projects, include:

![]() Tiger Global (with 70 deals in the first half of 2022),

Tiger Global (with 70 deals in the first half of 2022),

![]() Y Combinator (62 deals)

Y Combinator (62 deals)

![]() Coinbase Ventures (51 deals)

Coinbase Ventures (51 deals)

![]() Sequoia (50 deals)

Sequoia (50 deals)

![]() Accel (41 deals)

Accel (41 deals)

3) Issuance of bonds – is an alternative solution to seeking sources of funding from external investors. This method mainly applies to entities that are looking for significant cash. It consists in the issuance of securities (bonds) of a certain value. To put it simply, it is a kind of loan in which you undertake to provide the bond owner (investor) with a specific benefit, which may be monetary or non-monetary. In the case of the first variant, the investor has the right to get back the borrowed amount with interest. On the other hand, the non-monetary dimension is the possibility of obtaining certain rights, e.g. to a share in the company's future profits.

As a company that has been actively supporting the activities of fintechs for years,

we notice that their biggest challenge is finding a solid source of funding for the project created.

Piotr Hanusiak- CEO INCAT

III. Foundations and hubs for fintechs

Currently, the foundations and hubs that create an ecosystem supporting the development of fintech are becoming more and more popular. As part of cooperation with such an entity, fintech can count not only on project funding, but also on technological and business support. The main goal of such foundations is to connect people and organizations across the entire financial sector ecosystem, giving fintechs access to knowledge, experience, talents and investors. It is not uncommon to find economists, lawyers or IT specialists among the partners of such foundations. Business support at the initial stage of fintech development is also a significant advantage in terms of savings, because you do not need to invest in accounting or legal support, and it is known that the early phase of the project usually requires caution in spending money.

There are foundations supporting fintechs in almost every European market and it is worth knowing about their availability. For example, in one of the most dynamic fintech markets in Europe - i.e. in Poland, such foundations include among others Fintech Poland Foundation and Start-up Poland.

IV. Crowdfunding

The crowdfunding is a fairly new way to raise funds, which is currently gaining more and more popularity. In the context of financial solutions, this may not be an obvious idea, but it all depends on the type of the service offered. If the fintech offer is addressed to the B2C market and at the same time meets the conditions of an innovative and attractive solution, this form of at least partial funding can certainly be considered. The crowdfunding consists in presenting the project to a wider community through an online platform. The people interested in the project can make small, one-off payments for its implementation through thsi platform. In return for their financial contribution, numerous "investors" receive remuneration in the form of shares in future profits from the project, or they become co-owners of the project. This type of benefit exchange is a form of investment. It also happens that the remuneration for the investor is offered in the form of a finished product (pre-sale) for the implementation of which a collection is conducted.

Funding the project in this way opens up the possibility of reaching a wide audience thanks to the popularity of such platforms. On the other hand, a person looking for funds receives a quick message from the target group about whether the project is interesting and innovative enough to enter the market.

The largest crowdfunding services in Europe are:

![]() WhyDonate

WhyDonate

![]() Funding Circle

Funding Circle

![]() Crowdcube

Crowdcube

![]() Boomerang

Boomerang

![]() Ulule

Ulule

![]() Companisto

Companisto

![]() Seedrs

Seedrs

![]() Betterplace.org

Betterplace.org

V. Support from EU programs

The European Union offers financial assistance to start-ups under innovation funding programes. To a large extent, this is non-repayable funding, of course, after meeting a number of conditions set out in the funding regulations.

VI. Cooperation with banks

This is not about reaching for a loan - not at all. Especially since it is easier to obtain a loan for entities that are already operating in the market and have the creditworthiness. An alternative form of support is simply starting cooperation with one of the banks that offer innovation programs for fintechs. As part of such an exchange, fintechs can count on financial and legislative support, and banks implement their assumptions related to the development of innovation in the banking sector.

The most interesting projects in this area include:

![]() Start path created by Mastercard operator,

Start path created by Mastercard operator,

![]() Accelpoint co-created by Santander Cosumer Bank SA.,

Accelpoint co-created by Santander Cosumer Bank SA.,

![]() Let's Fintech, originated by Bank PKO BP - the largest bank in the region of Central and Eastern Europe (CEE).

Let's Fintech, originated by Bank PKO BP - the largest bank in the region of Central and Eastern Europe (CEE).

***

And if you are considering launching your financial project and need a core system that will be the main engine of your business, let us know. We have a solution for you.

Dynamic growth of BNPL services: challenges and opportunities for banks

For several years, the deferred payments service called BNPL (Buy Now Pay Later) has been gaining popularity among payment solutions on the market. And although fintech projects continue to be leaders in offering deferred payments, more and more traditional banking institutions are also considering including this solution in their business strategy. Can they win on this? And who can help in the implementation of the service?

The deferred payment solution gained particular recognition during the COVID-19 pandemic, which influenced the dynamic growth of the e-commerce market, which in turn generated the need for new, more-affordable options for financing online purchases. In addition, COVID-19 caused a drastic increase in the group of financially insecure consumers who simply needed more flexibility in their purchases. The solution, which allows the deferral of payments for 30 or 45 days, and even spreading them into installments, was a perfect match for these expectations. It’s estimated that in the pandemic year 2020, Americans alone made purchases under deferred payments in the amount of 20- 25 billion dollars.

How does it work?

The idea behind the BNPL service is very simple. BNPL allows the customer to order a product in an online store and pay for it later, in most cases without additional costs, after 30 or even 45 days. The customer usually orders a product in an e-shop, the shop receives immediate payment, and the customer settles the liability within 30 or 45 days. Payments can also be made in installments. The simplicity of the solution and the prospect of its dynamic development have resulted in more and more traditional banks, which are trying to gain a fair share in this rapidly growing market, seeing this service favorably. And there is a lot to compete for, because according to the estimates of Insider Intelligence, "the value of the volume of financial transactions within BNPL by 2025 will grow to an astronomical amount of USD 680 billion."

Twilight of credit cards

The second factor that may affect the decisions of financial institutions is the ongoing change in consumer habits in the use of payment solutions. Increasingly, more users of e-commerce services began seeing deferred, often interest-free BNPL solutions as an attractive alternative to often very expensive credit cards.

In a study conducted by the analytical company The Ascent, as many as 62% of respondents expressed the belief that "BNPL is a solution that will completely replace a credit card in the future." Similar conclusions can be drawn after analyzing the results of research conducted by Insider Intelligence. When asked about the reasons for using deferred payments, 39.4% (the dominant percentage) of respondents indicated the desire to avoid paying with a credit card. Slightly less – 39% – answered that "the decision was dictated by the desire to buy products that they would not normally be able to afford." In addition, 16.3% of survey participants chose BNPL because they "didn't like using credit cards."

Everything indicates that along with the global expansion of BNPL, the volume of credit cards will systematically decrease. As the Payments Journal points out, in 2020 alone, the three largest banks in the United States recorded a more-than-20% decrease in the number of credit card purchases year-on-year. And this value decreases every year.

Advantages of BNPL

A factor that may be crucial for financial institutions when deciding to implement this solution is certainly the wide spectrum of users declaring their use of the deferred payment service. As indicated by the analytical company The Ascent, although the service is used more often by younger consumers (over 60% for all age groups under 45), over 40% of consumers in the 55+ age group have used the deferred payment service at least once.

Another decisive factor may be the multiple benefits for people moving between different geographic regions. For these consumers, BNPL solutions can serve as an alternative to ones that require building a credit history in the consumer's new location.

Support tools: who to choose

Thinking about financial institutions that are looking for a tool to handle the purchase limit, at INCAT we created a special BNPL module, which is part of the "Lending" business line. Our tool allows a financial institution to expand its financial services package and introduce a new product line without interfering with the current architecture. The basic functions of the BNPL module in the BOS system include:

![]() managing payment terms within the agreed debt limit,

managing payment terms within the agreed debt limit,

![]() installment purchases,

installment purchases,

![]() spreading a group of purchases into installments,

spreading a group of purchases into installments,

![]() management of debt limits in the revolving loan model with control of payment dates,

management of debt limits in the revolving loan model with control of payment dates,

![]() creating payment schedules and managing deferred payment dates,

creating payment schedules and managing deferred payment dates,

![]() management of commissions and interest,

management of commissions and interest,

![]() support for repayment calendars (annuity, real calendar),

support for repayment calendars (annuity, real calendar),

![]() handling of repayments (directly or through dedicated accounts),

handling of repayments (directly or through dedicated accounts),

![]() the possibility of linking with card accounts and cards,

the possibility of linking with card accounts and cards,

![]() handling of overdue payments,

handling of overdue payments,

![]() accounting services for transactions and reclassification.

accounting services for transactions and reclassification.

An important element of the module is also the management of limits in the revolving account credit model, for which specific parameters can be defined, e.g.:

![]() loan repayment prediction based on current debt and transaction dates,

loan repayment prediction based on current debt and transaction dates,

![]() the ability to define the frequency of repayments,

the ability to define the frequency of repayments,

![]() possibility to postpone the due date of an installment by a predefined number of days,

possibility to postpone the due date of an installment by a predefined number of days,

![]() the possibility of linking fees and commissions with installment repayment dates,

the possibility of linking fees and commissions with installment repayment dates,

![]() a full credit service in terms of handling late payments, reclassification, interest and commissions for irregular payments,

a full credit service in terms of handling late payments, reclassification, interest and commissions for irregular payments,

![]() support for soft debt recovery.

support for soft debt recovery.

BNPL is certainly a solution of the future, and it may become a tool for banks, allowing organizations to position themselves as a "responsible financial institution", which determines what the client can afford, educates its group of clients, and also helps its community to avoid overspending. The institutions that will be the first to understand this and adapt the solution to their business strategy will win on the market.

***

If you are looking for tools to implement BNPL solutions, let us know.

***

About BOS:

BOS is a microservices-based, modern, and fully scalable transactional system dedicated to fintech, neo/challenger banks, as well as traditional financial institutions, where it can be used as complementary support for basic solutions. The BOS system, thanks to such functionalities as open API, allows for quick implementation of software and its easy integration with external systems.

The rise of Islamic banking products

The Muslim population in Europe continues to grow in both absolute and relative numbers. Following this trend, a rise in demand for Sharia-compliant financial products – or Islamic banking – is expected. Even though Islamic banking is deeply rooted in history and religion, as its foundations are derived from Qur'an, it’s the modern technology that facilitates the deployment of Sharia-compliant products for today’s neobanks and fintech companies.

With an estimated CAGR of 17.9%, the volume of transactions processed by Islamic fintech companies will rise significantly faster by 2026 than the global fintech industry (13.5%), according to Global Islamic Fintech Report 2022. As surprising as it may sound at first, Europe is one of the most important regions, fueling its growth. One of the main factors here is Europe’s growing population of Muslims. According to the analysis by Pew Research Center, their number will grow rise from 25.8 million in 2016 to at least 35.8 million in 2050, and that’s assuming a – rather unrealistic – “zero-migration” scenario.

The “Medium-migration” scenario increases this figure to 57.9 million, and “high migration” to a number as high as 75.6 million.

The European Islamic banking market is then likely to see a twofold rise in the number of customers over just 35 years. Such an opportunity is not to be overlooked. This market, however, needs very specific financial products that are fundamentally different from – so to speak – traditional ones. Banks, neobanks and fintech entities that intend to offer them need a core banking system designed to embrace these differences.

Money makes money? Not in Sharia

One of the unique characteristics of Islamic banking – or Sharia law that governs it – is the prohibition of riba. The word riba is commonly translated as interests, though its meaning is wider. According to Qur’an, money has no inherent value in itself and can’t be used to generate wealth. A Muslim can make profits on a legitimate business or asset investment, but not on lending money. For example, a loan must in returned in full quantity only, with no financial or material benefit for the lender. This makes all interests-based products – be it a deposit or a loan – forbidden in Islamic banking.

To function fully in modern society, some Muslims reckon that the sheer absence of interests sts make the “traditional” banking product compliant with Sharia law. B. But whereas it’s relatively easy to find a current account or deposit with 0% interest rate, it’s far more difficult to find a similar loan. Besides, many Muslim scholars dismiss such an approach as not fully legitimate under the Sharia law.

Lack of interest doesn’t rule out earning money entrusted to a bank or incurring the costs of financing. However, these profits and costs cannot be interest-based. Take Mudarabah as an example of product that can be roughly characterized as an equivalent of deposit – or investment, as it resembles entering a joint-venture. Instead of interests, the customer receives a share in profits from a given business project, transaction etc., agreed upon in advance.

It may seem a strictly investment product at first, but the nature of the business entered may be something as routine as day-to-day operations of a trading company that generates a steady, highly predictable and nearly risk-free revenue stream.

Another crucial difference: third parties

Mudarabah is a prime example of another fundamental difference between the Western and Islamic banking: the latter relies heavily on third parties. They are in fact sine qua non to numerous Sharia-compliant financial products.

This in turns means that the core banking system to support Islamic Banking product must not only operate in an “interest-e” environment. It also must be able to seamlessly integrate third parties’ operations, as capital and information flow between them and the customer is a prerequisite.

It’s worth to note that even though Islamic banking products are deeply rooted in centuries-old, religion-based law, they still may – and inf fact, should – provide a modern-day experience for customers.

Islamic banking products in BOS

Driven by technology advancements and growing demand, the number of providers of core banking systems that enable Islamic banking is increasing every year. Poland-based tech company INCAT Ltd. is one of them. During a recent deployment of BOS for a Saudi-Arabia based digital bank, we were given an opportunity to learn and understand challenges that lay before core banking system providers for Islamic fintechs and neobanks.

Following this project, based on BOS core banking system, we were able to design and offer a proprietary solution that supports Islamic banking products. BOS’ microservices architecture played a crucial role in the process. It allowed us to easily introduce and integrate new products – in this case, Sharia-compliant – without redesigning the system as such. New products are implemented as new microservices; third-party integration also takes place on a microservice level.

BOS’ microservices architecture played a crucial role in the process of offering a proprietary solution that supports Islamic banking products.

Such approach makes our flagship solution – a core banking system BOS- a bridge between Western and Islamic banking, as it is technically possible that Islamic and Western banking products co-exist even on a single BOS instance. More importantly, though, this approach allows Islamic fintechs and neobanks to take the full advantage of our core system’s reliability and flexibility. It also enables us to continually expand and modify our Islamic banking products range to meet our customers’ business needs. And as the market forecasts show – these needs are destined to grow.

***

About BOS system

BOS is a microservices-based, modern and fully scalable, Sharia-compliant transaction system, addressed to fintechs, -neo and challenger banks, as well as traditional financial institutions for which it can be used as a complementary support for basic solutions.

BOS system, thanks to such functionalities as open API, allows for quick software implementation as well as its easy integration with external systems.

Contact us for more information.

***

About the author

Michał Mazur is the Chief Architect Officer at INCAT Ltd.

Michał Mazur is the Chief Architect Officer at INCAT Ltd.

In his over 20-year career, he has been involved in many financial and IT sector projects. He has extensive experience in project management, analysis, business development, system architecture, and quality assurance.

Michał Mazur is a graduate of AGH University of Science and Technology (Warsaw, Poland).

Contact an author: michal.mazur@incat.com.pl

5 most popular applications of AI in banking

Almost 200 years ago, Charles Darwin said, "It is not the strongest or the most intelligent of the species that survive, but the one that adapts to change the fastest”. And although this thought originally referred to evolutionary processes, today it could well be a commentary on changes in the financial market.

AI and machine learning are technologies that have been increasingly used in banking in recent years. Banks are aware that in order to remain competitive, they must develop technologically, so they turn their focus to solutions that will ensure their growth. According to Accenture, by 2035, AI will double its annual economic growth rate, contributing to the evolution of working methods and building new relationships between humans and machines. In addition, forecasts indicate that artificial intelligence will increase the efficiency of enterprises by up to 40 percent, and enable employees to use their working time more efficiently. Undoubtedly, there are also a number of functionalities in the financial industry that can be optimized based on AI mechanisms, so we decided to take a closer look at them. We chose five key areas that we believe will soon be dominated by AI:

• customer service,

• customer experience,

• consulting (robo-consulting),

• data processing,

• cybersecurity and fraud detection.

Banks are aware that in order to remain competitive, they must develop technologically, so they turn their focus to solutions that will ensure their growth.

1. Customer Service

Although it’s difficult to imagine customer service utterly devoid of the human factor, AI modules can be effectively used mainly in process automation and contact channel management. Automating repetitive banking processes that don't require excessive verification not only saves a lot of money in the long run, but also reduces the number of mistakes, which are an integral part of manual handling. Artificial intelligence implemented in customer service processes also means increased efficiency and transparency of activities.

Due to changes in communication models, i.e., the transition from traditional channels to ones in which customers communicate with brands (social media, messaging, mobile applications), the number of channels that banks must use in order to contact their customers is growing every year. In this case, the solution doesn't have to be increasing the resources of customer service departments, but also, and perhaps above all, implementing an artificial intelligence module, for example, in chatbots or various types of virtual assistants. A well-configured chatbot is able to handle many more standard inquiries and problems faced by customers, and most importantly, it’s available almost immediately after the customer initiates contact.

2. Customer Experience

Artificial intelligence can also serve as a support in building the customer experience. Analysis and interpretation of data allow for even greater personalization, not only in terms of the offer, but also contact with the brand itself. User-specific content and high availability of services are just some of the elements of a good CX. Thanks to behavioral analyses and statistics generated in real time, banks can more accurately draw conclusions about customer needs. In addition, artificial intelligence helps in optimizing the customer journey – a touchpoint analysis helps identify problems that may affect the customer's "purchasing" decisions. According to an IDC report, artificial intelligence can optimize processes at almost every stage of the customer's contact with the bank, particularly in the following areas:

- Advertising, marketing and engaging processes at the stage of interaction between the brand and the customer. This allows a better understanding of the consumer, and tailors a unique and personalized service to them.

- Interaction with the consumer to provide additional information digitally and to support and help employees in cooperation with the customer.

- Direct and indirect customer and business support, getting the best value out of your transaction and resolving any problems or errors that may arise.

- Better understanding and supporting the relationship between the customer and the company, primarily through data analysis and interpretation.

- Focusing on customer characteristics through the use of artificial intelligence. Analysis of data collected on the customer to better understand their needs.

3. Consulting (robo-consulting)

An interesting area in the implementation of artificial intelligence is robo-consulting, i.e., automatic investment consulting for clients. It consists of artificial intelligence learning the client's needs on the basis of databases, and proposes investment strategies dedicated to the customer, then manages the assets until a specific profit is obtained. Robo-advisers also enable full automation of some asset management services and online financial planning tools. By analyzing a number of historical data, they’re able to make better predictions about the behavior of investment portfolios. At the same time, they help customers make better-informed spending and savings decisions based on behavioral analysis. However, the lack of appropriate legislation regulating the functioning of robo-advisory services may stand in the way of the development of these types of services. Nevertheless, in many countries, the situation is changing and, for example, in Poland – one of the largest fintech markets in Central and Eastern Europe – the Polish Financial Supervision Authority (the body supervising domestic financial institutions within the meaning of EU regulations) has prepared a draft establishing a formal position on robo-advisory services. The website of the organization stated: “The draft document is aimed at comprehensively referring to the most important issues related to the conduct of robo-advisory services, which should be included in the activities of the supervised entity. The project also applies to the entire process, from the service design phase to its practical implementation and monitoring of existing solutions. The position will be aimed at ensuring uniform implementation of robo-advisory services by interested financial institutions, while taking into account adequate protection of clients, especially non-professional investors.

4. Data processing

Due to their specific nature, banks process huge volumes of data on a daily basis. There are two challenges in this approach: how to do it quickly and how to extract the maximum amount of information from the data. AI addresses the problem of high performance and speed, and also allows for high-level inference based on highly advanced analyses resulting from machine learning. Robots based on cognitive technologies related to the development of artificial intelligence can analyze the content of correspondence with customers, verify the correctness of complex loan documentation, and make behavioral segmentation based on the actual financial behavior of customers or even provide consulting services.

5. Cybersecurity and fraud detection

In online banking, AI is primarily used for customer identification and fraud prevention. Credit card fraud has become one of the most widespread forms of cybercrime in recent years, driven by the massive increase in online and mobile payments. To identify illegal activity, artificial intelligence algorithms validate customers' credit card transactions in real time and compare new transactions with previous amounts and the locations from which they were performed. The system blocks transactions if it sees any potential risk. To combat fraud, organizations are also increasingly using biometrics, which makes it possible to recognize people based on their physical characteristics. This method assumes the verification of users before they log into the system, based on, inter alia, fingerprints, iris, or face shape (so-called facial recognition). Modules such as AML, Anti-fraud and KYC, supported by artificial intelligence, allow a significant reduction in the risk and losses related to financial fraud, which is reflected in the activities of organizations exposed to this risk.

Conclusion

The future of the banking industry in the context of the use of AI and machine learning is extremely intriguing. The progressive automation of the banking industry and greater openness to new technologies on the one hand realizes the huge potential of this service area, and on the other, opens the door to new threats and cybercriminals. That’s why it’s so important that the realization of tasks related to the implementation of artificial intelligence and machine learning takes place in accordance with good practices and with the participation of experienced technology and business partners.

ABOUT THE AUTHOR

Michał Mazur is the Senior Business Development Manager at INCAT Sp. z o.o. In his over 20-year career, he has been involved in financial and IT sector projects. He has extensive experience in project management, analysis, business development, system architecture, and quality assurance.

Michał Mazur is the Senior Business Development Manager at INCAT Sp. z o.o. In his over 20-year career, he has been involved in financial and IT sector projects. He has extensive experience in project management, analysis, business development, system architecture, and quality assurance.

Michał Mazur is a graduate of AGH University of Science and Technology.

Contact an author: michal.mazur@incat.com.pl

INCAT is a partner of the Fintech & Insurtech Digital Congress 2022

In just over a week – on September 27th, the 12th edition of Fintech & Insurtech Digital Congress starts in Warsaw – an industry event devoted to the development and modern technologies in the finance and insurance sector. INCAT – the BOS provider, is the official sponsor of the event.

FinTech & InsurTech Digital Congress is an elite forum for the exchange of thoughts and creating strategic partnerships, deriving from international experience. The autumn edition of the congress gained wide interest in the presentation of current trends such as: the new wave of Fintech 2.0 in the context of fintech valuation, challenges in building new era fintechs, condition of Polish fintechs, new bank business models, Embedded Finance & Insurance acceleration, investment in insurtechs, Insurance as-a-service, evolution of customer communication in a hybrid and digital interface.

INCAT has once again joined the group of partners of the event, which includes brands such as Raiffeisen Digital Bank, Sellions, Biuro Informacji Kredytowej BIK, Live Comply and many more.

Our company will be represented by Zdzisław Grochowicz – our Chief Product Officer, who will deliver a speech on the conscious look at modern fintech cloud services. The presentation will be part of the program block “Fintech&Insurtech stage. Brainstorm. Examples of implementations” and it will take place on the first day of the congress.

Alongside with Zdzisław, representatives of Polish and international financial institutions, fintechs and banks will perform on the stage (including Revolut, Twisto, BLIK, Klarna as well as PKO Bank Polski, PZU and Uniqua.)

The 12th edition of the event will be held on September 27-28th at The Westin Warsaw hotel. The full agenda and the important details of the event are available on FinTech & InsurTech Digital Congress.

See You in Warsaw.

5 reasons to switch from monolithic to microservices architecture

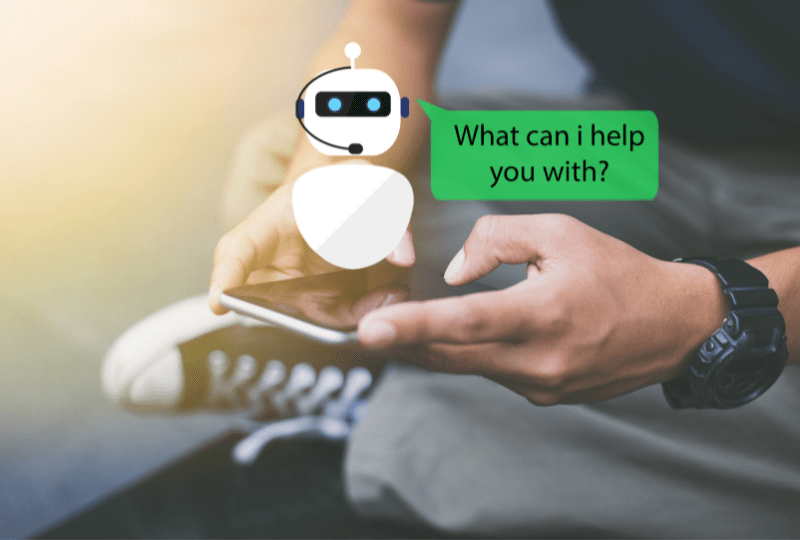

For the last several years on the IT market, we’ve been seeing the growing popularity of microservices, which are slowly pushing out monolithic architecture, which has been dominant to date. In contrast to the monolith, the structure of microservices is a set of many independent services and processes that together create an application.

Microservices are a convenient solution when creating an advanced system or large applications -– they allow for quick project implementation and simultaneous work on several modules. Although giants such as Netflix and Uber have based their solutions on microservices, this is not the only thing that makes this approach unique.

1) Flexibility

In contrast to the architecture of monoliths, microservices allow for easy modification of functionality in projects. Due to the fact that each microservice is an independent element of the application, subsequent components can be changed, added, and removed in such a way that it does not affect the functioning of the whole. Therefore, problems such as the cyclical change of automatic tests or the risk of stopping the entire application when implementing the next module are eliminated.

2) Easy integration

Open API, which is used in the microservices architecture, enables quick and trouble-free integration with other services. A solution such as API Gateway mediates communication between modules, allowing for convenient adaptation of the API to specific customers without the need to place it in each microservice.

3) Scalability

The modular approach allows quick and effective reactions to the dynamics of the business environment. Changing business requirements don’t mean restructuring the entire application, but only the module that relates to the given functionality. In addition, in the case of high loads, microservices enable an efficient increase in the number of instances that balance redundant traffic in the application, which also addresses the performance problem.

In case you’re considering implementing microservice architecture, the key question you should ask yourself is not "if?" but "how?"

4) Fast implementation

Microservices enable quick MVP release of the system. The implementation of a fully functional, basic application with this architecture that’s ready for further development is a matter of a few weeks. On the other hand, adding new modules and modifying existing ones don’t complicate customers’ use of the system in any way, because it’s simply less invasive than in the case of the monolith, and doesn’t affect the application core.

5) Independent development and autonomy

Distributed architecture also means independence for project teams. There is no central management center here, which makes the information flow smoother. Each team works on "its" component of the application and doesn’t have to take into account the databases or architecture of other modules. Interestingly, microservices allow you to develop each element in a different technology and language, and maintain services on separate servers and in repositories. This type of independence solves the problem of technical debt and increases the efficiency of the system itself.

Of course, microservices are not a cure-all. Currently, there’s no architecture that would be flawless and suitable for all types of applications. It’s no different with microservices. In case you’re considering implementing microservice architecture, the key question you should ask yourself is not "if?" but "how?". Neglecting these issues at the planning stage may result in the classic pouring out of the baby with the bathwater and, as a result, it will most likely turn out that the architecture, which was supposed to facilitate many processes, actually makes everyone interested in sleep.

If this is the case, it’s worth considering the support of a technical partner with experience in creating solutions based on microservices. This will help avoid many difficulties related to the implementation, and at the same time, you’ll be sure that you'll have an efficient release and a system that can be modified flexibly to adapt to rapidly changing business requirements.

ABOUT THE AUTHOR:

Michał Mazur is the Senior Business Development Manager at INCAT Sp. z o.o.

In his over 20-year career, he has been involved in financial and IT sector projects. He has extensive experience in project management, analysis, business development, system architecture, and quality assurance. Michał is a graduate of AGH University of Science and Technology.

Contact an author: michal.mazur@incat.com.pl

Put NOT a customer at the centre. A new approach to the customer-centric strategy.

Why you shouldn’t ask your customers what they want?!

It has been assumed that most companies, when crafting product portfolios, seek to understand customers’ needs first and then fine-tune product’ parameters so they’re best suited to answer these needs.

At INCAT, we believe that to be successful in today’s finance world, you need to take this approach two steps further…

Going two steps further…

1) Step one is focusing on customers’ stories rather than just their needs.

2) Step two is to jump into the story at the very moment it starts unfolding.

But what exactly do we mean by customers’ stories and how focusing on them can help you achieve business success?

Let’s start with an example.

Imagine a well-off individual who’s in the market for an expensive piece of electronics – say, a pricey TV. He or she may have a sufficient amount on a current account or credit card, but deducting the full price straight away would mean that the account would be swept clean for the rest of the month.

This, of course, calls for some sort of short-term financing: a loan, buy-now-pay-later or a similar product. If you have a solid grasp of customers’ needs and preferences, you’ll be able to tell which product would be best suited to their needs, and which of its optimal parameters and benefits to highlight.

Let’s take another case: a foreign vacation. All the excitement of holiday making – traveling, sightseeing, visiting tourist attractions, dining out, partying – inevitably tend to be followed (or sometimes preceded, e.g. booking a hotel) by a rather mundane string of transactions. These often include currency exchange, which can lead to a sobering realization of how costly it can be to just use your ordinary Visa or Mastercard.

Again, when you know your customers’ preferences, you should be able to present a product your customer perceives as optimal: quick currency exchange, a multi-currency payment card or a currency account.

There are two challenges, though.

First, although such a needs-based approach – or a customer-centric approach – tends to be more and more effective as your understanding of customers’ needs grows, it still has its limits. It doesn’t facilitate innovation, as it tends to keep you within the realm of products that customers already know.

This is a major drawback in a world that is being reshaped, and sometimes even revolutionized, by new products emerging on virtually a daily basis. Just think about how all the online currency exchange services have been made basically redundant with the emergence of Revolut.

Therefore, we believe that the customer-centric approach needs to be reimagined as a customer story-centric approach.

Introducing BOS’ customer story-centric approach

It’s tempting to think that customers need specific financial products in certain situations. It seems to be a very convincing point of view, since even customers themselves tend to adopt a product-oriented perspective. Buying a house? I need a mortgage. Buying a car? I need leasing and insurance – or maybe a deposit and insurance, if I choose to save up and finance the purchase myself. Going abroad on a regular basis? I need a multi-currency card. Getting a new TV? I need an installment loan.

But the truth is, customers don’t really need these financial products – they just use them to realize their true needs.

These stories can be simple or quite elaborate. Buying a TV is the former: it’s just making the purchase and paying for it in a way that doesn’t distress the monthly budget. Going abroad for a vacation? While a vacation might be an amazing adventure and make a great story that takes hours to tell, its financial aspect boils down to spending money and exchanging currency in the process, preferably quickly, hassle-free, and inexpensively.

Did you notice how we’re not talking about specific products here? This is deliberate. A product-free perspective lets you see more clearly what the core of the story is.

On the other hand, buying a car or house is usually a complex endeavor, with its stages interdependent on each other and more than one potential path from start to finish. In such cases, it can be virtually impossible to avoid bringing up specific products, because they are sometimes rigidly tied to a given process. Nevertheless, you should still be trying to sketch out the core story.

Once you’ve got it done, you can begin picking specific products – your own and third parties’ – to match it. The less they affect the underlying customer story and the more seamlessly they fit into it, the better.

Remember, your customers don’t really want to use your products. They only need them to have a great time on holidays, get a huge screen for their home cinema or drive a new, safe, eco-friendly car. The less time is needed to spend with your products, the less effort these products require and cost, and the more transparent they are – the better.

And the more likely it gets they’ll… grow to love using your products.

Your customers don’t really want to use your products. They only need them to have a great time on holidays, get a huge screen for their home cinema or drive a new, safe, eco-friendly car.

Real-time marketing turns into real-time banking

Of course, you might say that this is an approach that the financial sector is already starting to embrace. Even some of the biggest banks are aiming to make their products as “light” as possible, i.e. effortless to use and readily available via mobile apps with just a few taps.

They’re also getting better and better at targeting their customers and presenting them with products they likely need. If banks notice their customers are making frequent card transactions abroad, they offer them a multi-currency card or a currency account. Once the total amount on the monthly credit card statement reaches a certain level, they suggest paying it back in installments.

And this brings us to the second challenge we mentioned earlier.

By its very nature, customer profiling takes time. Also, it’s usually processed in separate systems, such as CRMs or dedicated analytical software. As a result, banks are usually weeks or at least days behind their customers.

This, however, is not the case with BOS. With BOS, you can jump into the customer’s story at the exact moment it is starting to unfold.

This is possible thanks to BOS’ event-driven architecture, which means that:

- every action taken by the customer is an event

- events are processed in real-time

- every event may trigger a system action, such as generating a transaction or sending a message to the customer (or other recipient).

With BOS, you can jump into the customer’s story at the exact moment it is starting to unfold.

In other words, every card transaction, every bank transfer (initiated or received by the customer), and every loan application submitted is an event – and so on. Also, every system-originated activity, such as charging a fee or generating a monthly statement, is an event.

And that’s not all, as events reach beyond financials: every time a mobile app is open also constitutes an event. So does logging in to your online banking system.

-> Your customer has just paid over $2000 in a consumer electronic store with your card? Ask them straight away if they want to split it into installments, or automatically “re-route” the amount to your buy-now-pay-later product.

-> It’s your customer’s third day abroad and their currency account is running low? Send a display notification suggesting currency exchange – or even process one automatically if the customer has chosen such an option earlier.

A specialized BOS module – the Event Orchestrator – lets your system administrators set up triggers and relations between events and create scenarios – such as the ones mentioned above or more – complex ones. Their number and level of sophistication depends solely on you. You can rely on the event definition supplied with the system, or create your own. Event Orchestrator is intuitive to use and ergonomically designed, so setting up scenarios is fast and requires only basic training.

The only limitation is the innovative spirit of your company, as well as its ability to spot emerging opportunities and its understanding of customer needs.

Or should we say: stories.

***

Have thought about this subject? Contact the author: zdzislaw.grochowicz@incat.com.pl

***

ABOUT THE AUTHOR:

Zdzisław Grochowicz is the Head of Business Development at INCAT. Zdzisław has been involved in the banking and financial sector for almost 30 years. Previously, he worked for Comparex Ltd. For many years he was also associated with the Sygnity Group – where he played numerous roles.

Zdzisław Grochowicz is the Head of Business Development at INCAT. Zdzisław has been involved in the banking and financial sector for almost 30 years. Previously, he worked for Comparex Ltd. For many years he was also associated with the Sygnity Group – where he played numerous roles.

Zdzisław Grochowicz graduated in Electrical Engineering at the Szczecin University of Technology.

approach can work in your fintech?

Ask us for details.

Core banking software list for 2022

9 top core banking solutions you should know

The banking industry is a sector of the economy, that, in recent years, has experienced very dynamic digitization processes, which were additionally strengthened and accelerated by the COVID19 pandemic. However, this is not surprising. A recent report released by Ernst & Young showed that almost 50% of banks did not modernize outdated IT systems as quickly as they should have, and almost 43% of American banks still used COBOL – a programming language developed in 1959! Fortunately, providers of more and more modern core banking solutions, created in almost all corners of the world, come to the rescue.

The definition of core banking

A back-end system that processes banking transactions throughout a bank’s multiple branches is known as core banking. Deposit, loan, and payment processing are all parts of such a system. In addition floating new accounts, servicing loans, calculating interest, processing deposits and transactions, and customer relationship management activities are all essential fundamental banking services in this type of system.

Core banking systems are designed to give existing and potential customers more control over their account activity. Thanks to technological advancements, transactions have become safer, faster, and less demanding. Core banking systems have been a critical feature of banking in recent years because these transactions can be completed remotely from anywhere on the planet.

Core banking solutions may reduce operational costs significantly, resulting in fewer work requirements for execution. They also allow customers to be more accountable. In addition, core banking systems are more user- friendly and efficient thanks to software application-based platforms. The advantages of core banking systems are numerous, including keeping up with a rapidly changing market, streamlining banking operations and making them more straightforward for customers, and expanding a bank’s reach to remote locations.

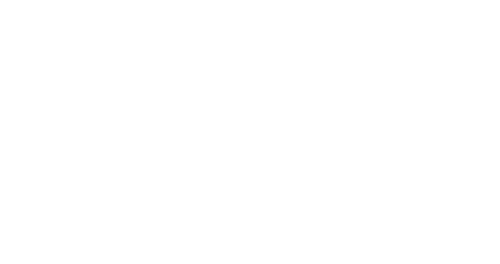

Born in the cloud

According to Gartner- by the end of 2023, public and private cloud will each account for 5% of commercial off-the-shelf (COTS) core banking installations for an overall 10% of the COTS market. New core banking software platforms are built on cloud and digital technologies and use open API-based architecture to better interface with various internal and external services and systems.

Lower costs, faster time-to-market and more superficial connections with multiple services that may improve customer experiences are all advantages of new core banking systems. However, developing core banking software in-house is a complicated and time-consuming process that can overwhelm teams and delay product launches. Many well-known fintech brands have outsourced their core banking software from fintech providers.

Below, we present nine of the most interesting IT solutions on the market that are worth considering when choosing a modern and technologically advanced transaction system for your financial business.

Core banking software list for 2022

1. Mambu – SaaS cloud banking platform

Launched in 2011, Mambu is a software-as-a-service, cloud-native, API-driven banking engine provider that powers lending and deposit services. The company enables financial institutions of all sizes to design, launch, service, and scale their banking and lending portfolio. It empowers over 7,000 loan and deposit products which serve over eight million end customers, with more than three million active accounts in over 46 countries, ranging from fintech to traditional banks. Mambu’s historical customer base includes microfinance institutions and fintechs. However, Mambu currently focuses on larger banks launching spinoffs or migrating. Its installation base is spread mainly across Western Europe, Latin America, and sub-Saharan Africa. The country with the most installations is the U.K.

2. Thought Machine – foundation of modern banking

Thought Machine is a fintech company that builds cloud-native technology to revolutionize core banking. Its mission is to solve one of the banking industry's primary problems: its reliance on outdated IT infrastructure. Nearly all banks are stuck on a legacy IT platform, which cripples their ability to innovate and give their customers the type of service they deserve.

The company provides a solution to this: Vault - a complete retail banking platform that's capable of being configured easily to suit the needs of any bank. They've built Vault from the ground up as a cloud-native, microservice API architecture platform. Thought Machine has a deep culture of engineering excellence, and they believe it's this that delivers a solution compelling enough to engender a seismic shift in the banking industry.

3. BOS by INCAT– bringing the digital revolution to banking

Founded in 2018 BOS is a fully flexible, cloud-native, and composable transaction system dedicated to fintech start-ups and neo/challenger banks. BOS has been created by INCAT – a fast-growing tech company that wants to empower companies to bring the digital revolution to finance and banking.

The BOS system is perceived as one of the most flexible banking software on the market, and is a first-choice solution for companies looking for quick implementation, reasonable costs, and easy integration with external systems. BOS is cloud-native, API-driven, and based on microservices software solution. It has been built from scratch to operate securely and efficiently in the cloud, but it can also be installed in any computing center (private cloud, on-premises).

BOS system is perceived as one of the most flexible banking software on the market

BOS' functionality is designed according to the Business Lines- concept (BOS Core, Payments, Savings, Lending, General Ledger) and is tailored to the customer's business ideas and goals. The system is available as a licensed solution with implementation and maintenance support, as well as a subscription model based on license rental with maintenance support, preceded by implementation of the system (low entry cost threshold). BOS is also a sharia-compliant core banking software. It allows its customers to run any financial products in compliance with Islamic law. The software is used by next-gen international fintech brands all around the world (Belgium, Saudi Arabia, Lithuania, Poland, Hungary etc.).

4. Temenos - a digital core-banking solution you can bank on

Temenos Group AG is a market-leading provider of banking software systems to retail, corporate, universal, private, Islamic, microfinance and community banks.

Headquartered in Geneva with 68 offices worldwide, Temenos serves over 1,000 financial institutions in more than 125 countries across the world. It was founded in 1993 in Geneva, Switzerland. From the outset, it had a simple mission: to rid the banking industry of its legacy software.

Ever since then, Temenos has worked to make this mission a reality. It has invested more than USD1bn in developing great banking solutions. It has grown its product set from core banking to payments, wealth management, business analytics and channels, offering a comprehensive set of solutions to meet the industry’s needs.

5. FIS - the foundation stone of a modern banking platform

FIS is an American multinational Fortune 500 corporation that offers a wide range of financial products and services.

FIS is best known for its development of Financial Technology - FinTech - and as of Q2 2020, it offers its solutions in three primary segments: Merchant Solutions, Banking Solutions, and Capital Market Solutions. FIS focuses on retail and institutional banking, payments, asset and wealth management, risk and compliance, and outsourcing solutions. It serves more than 20,000 clients in over 130 countries.

6. Oracle Flexcube - Core Banking Made for Tomorrow

FLEXCUBE is an automated universal core banking software developed and introduced by Oracle Financial Services. This solution is designed for financial organizations and banks. It offers customer-centric core banking functionalities. It ensures a holistic view of all customers and enhanced communication between bank employees and consumers.

Due to FLEXCUBE’s opensource environment and multiple API management, its users can create their business logic and interfaces, as well as integrate the system with third-party applications. This international core banking system is compliant with various regulations and suitable for any bank in over 115 countries.

7. Finastra – the future of banking

Formed in 2017 by the merger of Misys and D+H, Finastra provides a broad portfolio of financial services, spanning across retail banking, transaction banking, lending, and treasury and capital markets. The solution enables customers to deploy mission-critical technology on-premises or in the cloud. Finastra is an open and reliable solution that allows customers to accelerate growth, optimize costs and mitigate risk. Forty-eight of the world’s top fifty banks use Finastra technology.

8. nCino - by bankers for bankers

Launched in 2012, nCino offers a cloud-based bank operating system created by bankers for bankers. The system helps increase profitability, productivity gains, regulatory compliance, and operational transparency at all organizational levels as well as across all lines of business.

Following a process structure similar to a bank’s loan accounting system, this bank operating system offers combined services through its business process management, loan lifecycle, business intelligence, and document management solutions.

9. Backbase - re-design your bank around the customer

Backbase was founded in 2003 and provides all the building blocks banks need to fast- track the implementation of their next-generation digital banking vision. The platform enables banks to create and manage seamless customer experiences across any device that's directly integrated with any back-end system. Superior digital experiences are essential to staying relevant to consumers, and Backbase enables financial companies to rapidly grow their digital business.

More than 150 banks and credit unions around the world have standardized the Backbase platform to streamline their omnichannel/digital operations, including ABN AMRO, Barclays, CheBanca!, Credit Suisse, Deutsche Bank, Fidelity, Hapoalim, HDFC, KeyBank, NBAD, OTP, PZU, PostFinance, Societe Generale, and Westpac.

As we can see in the above list, there are more and more solutions that can respond to increasingly demanding fintech companies.

However, it's worth looking for a solution that in addition to its technologically advanced architecture, is able to flexibly adapt to all of our needs and enable a quick launch of any financial product.

Want to build a fintech unicorn?

Although it is still believed that the success of a fintech startup revolves primarily around an innovative product and great marketing, in the context of this demanding business, this is just the tip of the iceberg. In addition to the challenges related to financing the business or taking care of formalities, such as licenses and approvals for financial activities, other aspects also need to be taken care of. The most important activities include selecting and implementing the appropriate technology on the basis of which you can freely build your product. In the following text I will try to explain why, in my opinion, the modern technology dedicated to fintechs supports not only the technical aspects of the product but also gives financial entities a significant business advantage.

A solid foundation is the key to success

Each institution that begins financial activities must base them on a transaction system that, in the simplest terms, processes and organizes data about customers, their accounts and transactions. The system is the basis, and it's built around additional functionalities such as front-end mobile and browser applications, AML and anti-fraud systems, KYC (Know Your Customer) modules and currency transfers. To date, the role of transaction systems has been limited primarily to the functions listed above. They were aimed at enabling efficient financial activity in a manner that is consistent with the assumptions of compliance. However, transaction systems are currently playing an increasing role in shaping the products and services of fintechs as well as support in the field of marketing and product development. Today, the transaction system is important not only from a technology perspective but also from a business one. How is this possible?

Good product is smart marketing

Nowadays, a great advantage of fintech is not only an innovative product, but also the ability to implement new business functions as quickly as possible and to respond to new customer needs. To achieve this, it is worth first focusing on a transaction system that enables the efficient creation of a modern offer, and maintains existing products, aimed at consolidating the business advantage.

By creating the BOS transaction system at INCAT, we noticed that our clients need solutions that, irrespective of their original application, address the requirements of a modern end customer in the customer-centric model.

Therefore, currently modern financial entities require core systems with the functionalities not only focusing on the technological and product layer but also supporting an innovative approach to processes that addressing customer needs. Today, customers are not looking for a savings account with specific parameters, but a set of functions that will at a reasonable price efficiently achieve their goals in compliance with quality and safety standard.

Core banking engine supports your business

In the light of the above, we need to ask the question "which areas do a modern transaction system work in"? and "what functionalities can play the role of autonomous processes directed at specific target groups"? The advanced technology behind modern banking solutions actually has no functional limitations. Whether we create solutions only to solve a problem, or also to provide new opportunities, depends only on the boundaries we impose on ourselves. The mindset at INCAT, supported by the creativity of our clients, has always been focused on full business usability. Hence, ideas on how to develop this area in our solutions come to us quite easily. I am often asked about examples of the functionalities of the transaction system, which are also characterized by considerable marketing value. In response, I quote specific products, that are ready to be used in financial activities. These include partner programs, automated cascade currency conversions, or support for white labeling (multi-brand).

Partner Program

The transaction system can be used when creating a product such as a partner program. Thanks to this functionality, entities offering their customers a system of collecting points, obtaining discounts or quick returns can build the long-term loyalty of their recipients. An example of a great implementation of this tool is the ZEN card offered by the dynamically developing fintech ZEN.COM, which provides a number of benefits for its users, such as extended warranty and a quick cashback module.

Currency cascade

This is another example of a very interesting solution that makes it easier for customers to make payments under non-standard conditions. It allows for the automatic use of the customer's funds accumulated in various currencies during the execution of a single transaction if there is a lack of funds on the main account or an account kept in the currency of the transaction. In other words, if a customer makes a payment of EUR 40, with only EUR 30 available on the account, the payment system automatically takes the missing amount from the remaining foreign currency accounts, e.g. in USD or PLN by making an immediate currency conversion. The whole process takes no longer than a standard contactless payment and doesn't require any activity on the customer's side. Currency cascade is another example of a solution that's available to users of a payment card offered by the ZEN.COM fintech.

Multi-brand

Multi-brand is a functionality that enables the separation of independent environments of several brands and institutions, administered by one entity.

This is a great solution for institutions that decide to offer products directed at various target groups and different market segments.

An example of using this product is the offers of large loan companies. In order to expand their customers' portfolios, they create several loan brands that differ in their parameters and terms of obtaining financing. At the same time, they are formally part of one large capital group and don't have any business relations. The system also supports the possibility of running many independent brands/institutions thanks to the tight separation of parameters and data as well as proven performance. The advantages of multi-brand are already noticed by some Polish fintechs that use this functionality, for example, to integrate their own financial products with the offers of their partners.

The above-mentioned examples are only a small sample of what can be achieved in the field of financial product development, with a modern transaction system at your disposal, the open architecture and adopted solutions of which allow for their quick implementation. Today, in the era of modern banking, it is not enough to do something well enough - you have to stay ahead of trends and create solutions that respond to needs that are yet to emerge. It's worth spreading this awareness so that the promising fintech industry, develops even faster, creating a completely new quality in the financial market.

ABOUT THE AUTHOR:

Michał Mazur is the Senior Business Development Manager at INCAT Sp. z o.o.

Michał Mazur is the Senior Business Development Manager at INCAT Sp. z o.o.

In his over 20-year career, he has been involved in financial and IT sector projects. He has extensive experience in project management, analysis, business development, system architecture, and quality assurance.

Michał Mazur is a graduate of AGH University of Science and Technology.

Contact an author: michal.mazur@incat.com.pl

Flexibility is King

- technology: IT solutions that allow for scalability in both quantitative and qualitative aspects,

- functionality: ability to easily shape and modify the customer stories to perfectly fit customer’s needs and the company’s marketing strategy,

- implementation: an agile approach to launch and system development,

- business: pricing adapted to the scale of operations.

THE FOUNDATION: FLEXIBLE FUNCTIONALITY

TECHNOLOGY MUST BE UP TO THE TASK

Hardware ceases to set limits for operations: cloud-based core banking systems can serve 10 million customers as easily as it just served 10 thousand. Even though it’s hardware, it still can – and should – be flexible.

KEY TO IMPLEMENTATION: AGILITY

BUSINESS MODEL ALIGNED TO STARTUP’S NEEDS ALIGNMENT

ABOUT THE AUTHOR:

Zdzisław Grochowicz is the Head of Business Development in Incat. Zdzisław has been involved in the banking and financial sector for almost 30 years. Previously, he worked for Comparex Ltd. For many years he was also associated with the Sygnity Group – where he played numerous roles.

Zdzisław Grochowicz graduated in Electrical Engineering at the Szczecin University of Technology.

Contact an author: zdzislaw.grochowicz@incat.com.pl